Managing Monthly Expenses Like A Pro – 10 Habits That Make You Richer Over Time

Managing monthly expenses is one of those real-life skills everyone talks about but few actually get the hang of. It’s not about making a massive income or being a math genius. What it really comes down to is knowing where your money is going, building smarter habits, and sticking to a system that works with your lifestyle—not against it. If your paycheck feels like it disappears without a trace every month, this guide is for you.

These 10 down-to-earth habits aren’t here to take away every small joy—they’re meant to put you back in charge of your finances, one clear choice at a time. Once you start using these habits, your money begins working for you instead of slipping away unnoticed.

Let’s break down the key strategies for staying on top of your money.

Table Of Contents

1. Know Exactly Where Your Money Is Going: The First Step to Control

The first—and arguably most important—habit for managing monthly expenses is surprisingly simple: keep track of every dollar you spend. Yes, all of it. This isn’t just about your rent, mortgage, or grocery trips. It’s also the daily coffee runs, the subscription services you barely use, and those “just this once” online buys. If you don’t know where the leaks are, you can’t fix them.

Whether you prefer a budgeting app, an organized spreadsheet, or just a basic notebook, the point is the same—awareness. When you can clearly see your financial picture, the places where money is quietly slipping away become obvious. And that’s the foundation of all smart personal budgeting habits.

2. Create a Budget That Matches Your Real Life

Forget trying to build a perfect spreadsheet or use an overly complicated app that doesn’t fit into your routine. The best budget is the one that reflects how you actually spend—not how you wish you did. If you want to truly understand how to manage monthly expenses, your budget needs to be practical and honest.

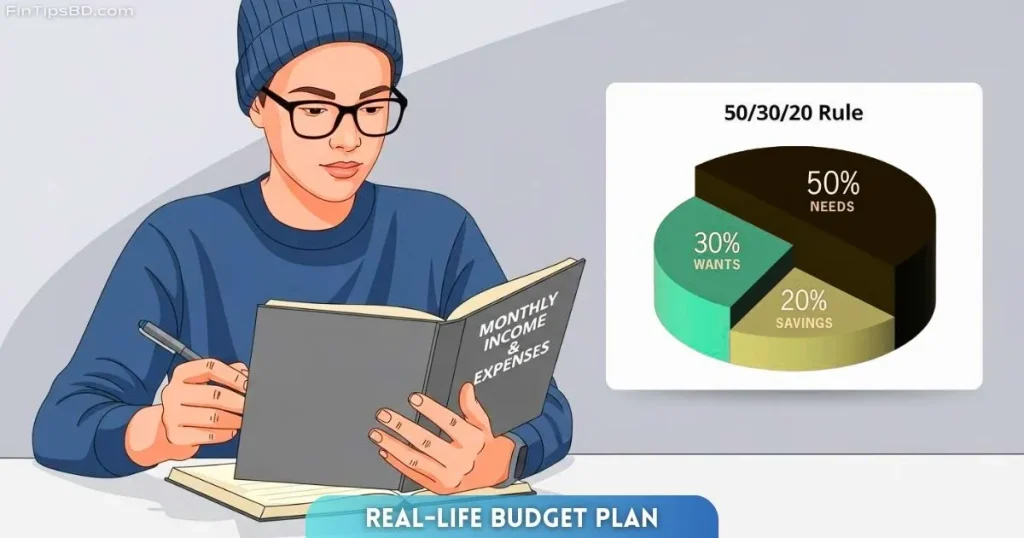

Start with your net income (what you take home after taxes and deductions). Subtract your fixed costs—things like rent, utilities, loan payments, and a realistic grocery allowance. Then divide what’s left between savings, your emergency fund, and flexible spending. A great beginner-friendly method for budgeting for beginners is the 50/30/20 rule:

- 50% for Needs: Essentials like housing, groceries, transportation, and basic bills.

- 30% for Wants: Fun stuff—eating out, streaming services, hobbies, and personal treats.

- 20% for Savings or Debt Repayment: Put this toward your emergency fund, retirement, or paying down loans faster.

Managing monthly expenses is a whole lot easier when your budget is built around your actual life—not some fantasy version of it.

3. Be Brutally Honest About Needs vs. Wants

Here’s the thing—most people don’t end up broke because they spent money on things they truly needed. The trouble usually starts when wants get treated like needs. If you’re serious about trying to reduce monthly costs, you’ll need to take a hard look at what’s essential and what’s not.

Go through your spending with a clear head. That third streaming service? Probably a want. The daily fancy coffee shop visit? Almost definitely a want. Start cutting or replacing those extras with cheaper alternatives that don’t take away from your real priorities. A simple way to think about it: if it doesn’t feed you, house you, or keep you safe, it’s probably optional. Getting this distinction right is key to improve monthly finances.

4. Put Your Bills on Autopilot

Managing monthly expenses becomes way easier—and less stressful—when you take the guesswork out of it. That’s where automation comes in. Think of it as your built-in safety net against missed payments and forgetfulness.

Set up auto-pay for all your fixed, must-pay expenses:

- Rent or mortgage

- Utility bills (electric, water, internet)

- Credit card minimums (or ideally, pay the full balance)

- Savings and investment contributions

When these payments run automatically, you’re less likely to miss a due date, rack up late fees, or fall behind. Plus, it forces you to prioritize what matters most before you even get the chance to overspend. This is one of those solid financial planning habits that keeps your money life stable with minimal effort.

5. Do a Quick Money Check-Up Every Month

One of the smartest personal budgeting habits is taking 30 minutes at the end of each month to see how things really went. It’s your personal finance check-up—no spreadsheet panic needed.

Here’s what to do:

- Compare what you planned to spend with what you actually spent

- Spot the areas where you went over budget

- Make small, realistic changes to your plan for the next month

This isn’t about beating yourself up—it’s about learning and adjusting. Over time, you’ll start making sharper money decisions just by seeing your patterns. If you’re serious about track monthly spending, this monthly review is non-negotiable.

6. Cancel What You’re Not Using (Seriously)

Subscriptions have a sneaky way of draining your wallet. A few bucks here, a few there—it adds up fast, especially when you’re barely using them. Cutting these out is a simple way to reduce monthly costs without giving up anything you’ll truly miss.

Here’s your game plan:

- Go through your bank and credit card statements

- Highlight every recurring charge

- Ask yourself: Have I used this in the last month? If not, cancel it

- For services you do use, see if you can negotiate a better deal or downgrade your plan

You’re not depriving yourself—you’re just trimming the fat. The goal isn’t to live like a monk. It’s to stop paying for stuff that’s doing nothing for you.

7. Use the 24-Hour Rule to Beat Impulse Buys

Impulse shopping can crush your budget before you even notice. That’s why the 24-hour rule works so well—it gives your brain a chance to cool off before your wallet takes a hit.

Here’s how it works:

Before buying something unplanned (especially non-essentials), pause.

- Leave it in your cart

- Walk away

- Sleep on it

Revisit it the next day with a clear head. Chances are, you’ll realize you don’t really want it anymore. Over time, this small pause adds up and helps you save money each month without feeling restricted. It also strengthens your overall awareness about how and why you’re spending.

8. Find Small Ways to Boost Your Income

There’s only so much you can cut before the savings start to shrink. At a certain point, you’ll get more mileage by looking for ways to bring in extra money. Part of smart managing monthly expenses is thinking about how to grow your income—not just reduce your spending.

This doesn’t mean quitting your job. Small additions can make a real difference:

- Pick up freelance work, tutoring, or sell a skill you already have

- Sell unused items lying around your home

- Take an online course that helps you qualify for a raise or promotion

Even making an extra $100 a month can loosen up your budget, help you pay off debt quicker, and give your savings a boost. This is a key move if you’re looking to improve monthly finances without feeling like you’re stuck.

9. Build a Small Emergency Fund First

Before you throw every spare dollar into investing or debt payoff, build a simple emergency fund. This is one of the most overlooked but essential financial planning habits—and it can save you from financial stress down the road.

Why does it matter? Because life doesn’t ask permission to throw curveballs. Cars break down. Pets get sick. A bill comes out of nowhere. If you don’t have backup cash, you’re more likely to turn to credit cards—and end up deeper in debt.

Start with something doable. Aim for $500 to $1,000, or at least a month’s worth of essential living costs. That small fund acts like a shock absorber for your budget. It helps you stay on track, avoid panic spending, and save money each month in a way that actually feels sustainable.

10. Think Long-Term, Not Just Month-to-Month

This last habit isn’t about apps or spreadsheets—it’s about mindset. When you’re managing monthly expenses, it’s easy to get caught up in just making it through the next few weeks. But to build real financial health, you’ve got to zoom out.

Before making a big or unnecessary purchase, ask yourself:

“Will I still be glad I spent this money a year from now?”

It’s a small question, but it packs a punch. It pushes you away from instant gratification and toward longer-term financial stability. You’re not trying to be cheap—you’re aiming to be intentional. That shift in thinking is at the heart of all great monthly budget tips.

Final Thoughts: Take Control Without Burning Out

Managing monthly expenses isn’t about giving up everything fun or obsessing over every receipt. It’s about making smarter choices—on purpose. It’s about telling your money where to go instead of wondering where it went.

Start with just one or two of these habits. Keep at them. Once they become second nature, add another. Over time, those small shifts turn into real momentum. Your savings will grow. Your money stress will shrink. And eventually, you’ll stop just getting by—and start moving forward.

Budgeting isn’t about being perfect. It’s about making steady progress. The sooner you start, the sooner you’ll feel in control—and the closer you’ll get to building the financial life you actually want.