Do You Really Need Life Insurance? Most People Don’t Know This!

When it comes to protecting your family’s future, few financial options provide the same sense of security and practical support as life insurance. Still, it’s often one of the most overlooked and misunderstood parts of personal finance. Many people wrongly assume it’s only for older adults or that it’s too costly to be worth it. In reality, the opposite is true—life insurance can be a smart and surprisingly affordable way to protect your loved ones, offering vital support when they need it most.

This easy-to-follow guide will break down everything you need to know about life insurance: what it really does, who needs it the most, the different types available, and how to figure out if it’s the right fit for you.

Table Of Contents

What Is Life Insurance, and Why Is It So Important?

At its core, life insurance is a simple agreement between you and an insurance company. In return for regular payments (called premiums, usually paid monthly or yearly), the company promises to give a fixed amount of money—called the death benefit—to the person you choose if you pass away while the policy is active. This person, known as your beneficiary, could be your spouse, kids, parents, or anyone else you want to support financially.

This payout isn’t just money—it’s a safety net. It can be used to handle everyday expenses, mortgage payments, unpaid loans (like car or student loans), funeral costs, and even future needs like college tuition. Life insurance gives your family financial breathing room, helping them keep up with bills and stay on track even after you’re gone. It’s about giving them stability and time to grieve without added money worries.

Busting Common Myths About Life Insurance

Even with all its benefits, many people avoid getting life insurance because of common myths. Let’s clear up some of those false ideas.

1. “I’m too young to need life insurance.”

This is one of the most common misunderstandings. In fact, getting life insurance when you’re young comes with a big perk: lower premiums. Healthy people in their 20s or 30s can lock in very low rates that often stay the same for the full term of the policy. As you get older or if your health changes, the cost goes up. So, buying early can save you a lot over time.

2. “I’m single with no kids, so I don’t need it.”

Even if you don’t have a spouse or children, that doesn’t mean life insurance is useless. Think about this: Have you cosigned a loan with someone? Do you have elderly parents who might need help from you later? Do you owe money that someone else might have to pay if something happened to you? Even just covering funeral costs can be a reason to have a policy. Life insurance can take care of these things so others aren’t left with the bill.

3. “It’s too expensive.”

Many people assume life insurance is out of their budget without even checking. But a basic term life policy—especially for healthy young adults—can cost less than what you spend on coffee or a streaming subscription. Thanks to online tools, it’s now easier than ever to compare prices and find something that fits your budget. Protection doesn’t have to break the bank.

Who Should Seriously Consider It?

This is a key question—and one that many people get wrong. If you fall into any of the groups below, you should strongly think about getting life insurance:

- You have a spouse, kids, or others who depend on your income: This is the most common reason. If someone relies on your earnings to pay for daily expenses, rent or mortgage, or future needs, life insurance is essential.

- You’re a single parent: As the only provider, your income is the lifeline. Life insurance helps ensure your children are taken care of financially if you’re no longer around.

- You own a home with a mortgage: A life insurance payout can pay off your mortgage, helping your family keep the home without struggling.

- You have student loans co-signed by family. Without a policy, your co-signer—like a parent—could be left responsible for the remaining debt.

- You run or co-own a business: Life insurance can help keep the business running, pay off business loans, or even buy out your share if you pass away.

- You want to leave behind a financial gift or legacy. Even if you don’t have pressing needs now, a policy can help with estate planning or charitable giving.

- You carry personal debt: Things like car loans, credit cards, or personal loans can become someone else’s problem after your death. Life insurance prevents that.

However, if you have zero debt, no financial dependents, and enough savings to cover your final expenses, life insurance might not be urgent. Still, that’s rare—for most people, a policy is a wise move.

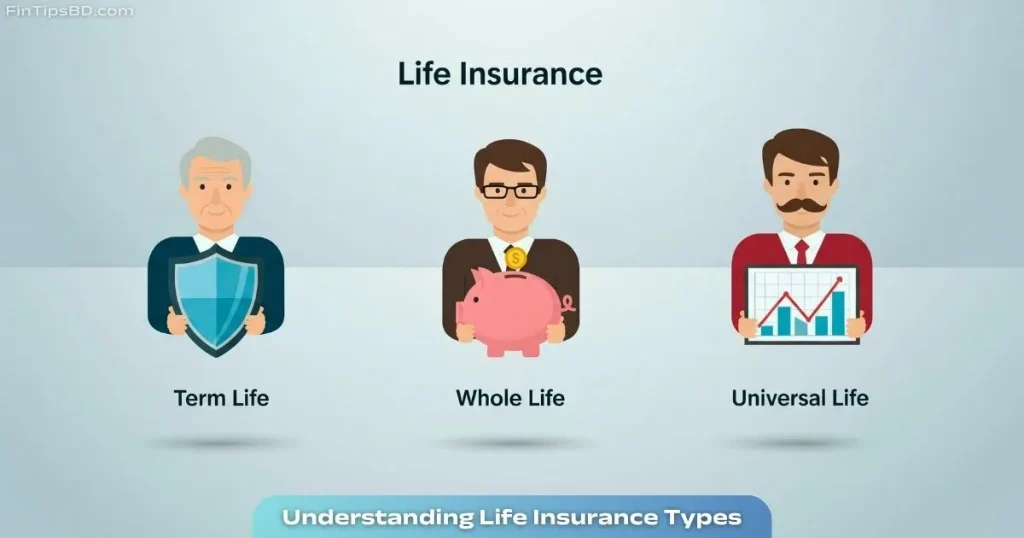

Understanding the Types of Life Insurance

Choosing the right life insurance means knowing what kind fits your situation. There are two main types:

1. Term Life Insurance—Simple and Budget-Friendly

Term life insurance gives coverage for a set number of years—often 10, 20, or 30. If you pass away during this time, your beneficiary gets the payout. If the term ends and you’re still alive, the policy ends unless you renew it (usually at a higher cost) or convert it to permanent coverage.

Main features of term life insurance:

- Lower cost: This is usually the most affordable type of policy, ideal if you’re on a budget.

- Easy to understand: It’s straightforward and doesn’t have extra features.

- Great for short-term needs: Perfect if you want to cover things like a mortgage, raising kids, or big debts for a certain period.

When the term ends, the protection stops. It’s a good choice if you need coverage for a specific period of time.

2. Permanent Life Insurance—Lifelong Support With Extra Value

Permanent life insurance—which includes whole life and universal life—lasts your entire life, as long as you keep paying the premiums. It also builds something called cash value, which grows over time and can be used while you’re still alive.

Main features of permanent life insurance:

- Coverage that lasts forever: You’re protected no matter how long you live.

- Grows cash value: Part of your payment goes into a savings portion that builds up.

- You can use the money: You can borrow from it, take money out, or cancel the policy and get the value (though that may affect the death benefit and have tax effects).

- Good for planning ahead: It’s often used in estate planning to leave an inheritance or donate to charity.

While more expensive than term policies, permanent life insurance gives both lifetime protection and a savings feature, making it a smart choice for long-term planning.

The Real-Life Benefits

Life insurance isn’t just about leaving money behind—it offers real, practical support in some of life’s hardest moments. Here’s how it helps:

✔ Covers Final Expenses: Funerals and burials can cost anywhere from $5,000 to $15,000—sometimes more. Without insurance, your loved ones could be left to cover those costs while grieving. A policy makes sure they can give you a proper goodbye without added financial pressure.

✔ Pays Off Outstanding Debt: If you leave behind credit card balances, a car loan, or a mortgage, those debts don’t just go away. In some cases, your family might have to deal with them. Life insurance helps pay off what you owe, protecting your family from being stuck with your financial obligations.

✔ Replaces Your Income: Your income probably supports your family’s daily life—rent, groceries, savings, and future goals. If something happens to you, life insurance can help replace that income so your family can stay on track and maintain their way of living.

✔ Gives Time and Peace of Mind: Losing a loved one is already emotionally painful. Add money worries to that, and it becomes even harder. Life insurance offers breathing room—time to grieve, adjust, and move forward without panicking over bills. That sense of peace is one of the most valuable things a policy can provide.

How Much Life Insurance Do You Really Need?

Figuring out how much coverage you should get is personal—there’s no one perfect number. But a common rule of thumb is

Annual income × 10 to 15 years = Suggested coverage

For example, if you earn $50,000 a year:

- $50,000 × 10 = $500,000

- $50,000 × 15 = $750,000

This gives your family enough financial support to cover living costs for a decade or more.

But don’t stop there. Consider other specific costs too:

- 🏠 Your mortgage: Make sure the policy can cover what’s left on your home loan.

- 🎓 Kids’ education: Factor in college tuition, books, housing, and other fees.

- ⚰️ Funeral expenses: Estimate how much will be needed for burial or cremation.

- 💳 Personal debts: Add up your credit cards, car loans, or other personal loans.

- 👨👩👧👦 Ongoing income replacement: Think about how many years your family would need financial support.

There are plenty of online life insurance calculators that can give you a more tailored estimate. They ask about your age, lifestyle, debt, and financial goals to help you find a realistic number that works for your situation.

How to Buy Life Insurance—Step by Step

Buying life insurance may feel overwhelming at first, but it’s actually a simple process when broken down into a few clear steps:

1. Figure Out What You Need

Start by taking a close look at your current finances. How much do you earn? What debts do you have? Do you have children or other people who rely on your income? Think about how much support your family would need—and for how long—if you weren’t around.

2. Pick Between Term and Permanent Coverage

Based on your needs and your long-term financial plans, decide which type of policy works best:

- Term life insurance is great for short- to mid-term needs, like paying off a mortgage or supporting young kids.

- Permanent life insurance offers lifelong coverage and can also help with saving and estate planning.

Choose the one that fits your budget and goals.

3. Compare Quotes and Providers

Don’t just go with the first company you find. Use online comparison tools or speak to an independent insurance agent to get quotes from different insurers. This helps you find the best coverage at the best price for your unique situation.

4. Fill Out the Application Honestly

Once you choose a policy, you’ll fill out an application. Be completely honest about your health, medical history, and lifestyle. Depending on your age and the amount of coverage you want, you may also need to take a medical exam. This usually involves a nurse checking your vital signs and collecting blood or urine samples.

5. Wait for Approval and Start Your Policy

After submitting your application and, if required, completing your medical exam, the insurance company will review everything. They might:

- Approve your application as is.

- Approve it with some changes (like slightly higher premiums).

- Decline your application (usually only in rare or high-risk cases)

Once you’re approved, start making your premium payments to keep your policy active and your family protected.

Life Insurance Is About Life, Not Just Death

A lot of people think life insurance only matters after someone dies—but that’s missing the bigger picture. The real power of life insurance is the peace of mind it gives you while you’re still alive. It means knowing your family won’t be financially lost if something ever happens to you.

It means your children can still go to college, your partner can keep the home you built together, and your loved ones won’t face financial hardship while they grieve. It means your legacy continues, even when you’re no longer here to give it directly.

So if someone depends on you—or if you have any debts or financial responsibilities—the answer is clear: yes, you do need life insurance. It’s one of the smartest, most caring decisions you can make. And the good news? It’s often far more affordable than you might expect.

Life insurance isn’t just about protecting the future—it’s about providing security today.